Regulatory Convergence -2020 Perspective

2020 Regulatory Convergence Pays Off

The following article briefly walks through the current state of regulatory convergence that is occurring at both countries and company levels. It looks at some of the harmonization concepts that are being implemented by countries and companies in Asia, with specific examples of the harmonization work that is being done in both China and India.

The article briefly touches on the potential impact to global health systems if these countries and companies continue to succeed. Europe is a great example of the impact that can be realized by these external countries and companies entering their health system. Biocon, Celltrion and Intas EU biosimilar approvals have driven drug prices to 70% of their originator pricing and as result has saved the EU health system Billions of dollars along the way. We believe that this has been as a result of regulatory convergence and harmonization of local processes and systems with expectation from highly regulated markets like US, EU and Japan. What follows is simplistic view of how this convergence that started in the late 2000s will impact the global health systems and what are some of the challenges that have been overcome. The article is meant to tease out several observations and provide some insight of what successful companies have done to achieve early success.

As global economies wrestle with the impact of the healthcare systems on GDPs across the globe, there is an expectation that a globally harmonized regulatory framework must be part of the equation. In other words, a movement called “Regulatory Convergence”, whereby the regulatory bodies across participating countries adopt a unified system for marketing approvals of drugs, biologics, and devices to ensure the highest standards of quality, reporting and advertising. A notable current example is the effort by the Chinese health agency.

In March 2013, the State regulatory body (State Food and Drug Administration) was replaced with a newly designed entity is the China Food and Drug Administration, at the same time elevating it to a ministerial-level agency. This move marks China’s strategy to become a global supplier in the trillion-dollar, global healthcare market. In 2018, the CFDA was renamed to the National Medical Products Administration (NMPA) and merged into a larger charter called the State Administration for Market Regulation. NMPA replaces a large group of overlapping regulators with an entity similar to the Food and Drug Administration of the United States, streamlining regulation processes for food and drug safety. The National Medical Products Administration receives oversight from the State Council of the People’s public of China, which has overarching safety management of food, health, and cosmetics and is the competent authority of drug regulation in mainland China.

India is another great example of Regulatory Convergence. The regulators and the government are ratcheting up their regulatory requirements to better align with the practices with ICH, US FDA and EMA. India drug developers have already initiated commercialization of technologically advanced biologics, demonstrates their willingness to embrace a stricter regulatory environment. Intas and Biocon are examples of companies ratcheting up their regulatory and quality systems which has resulted product launches in the US and Europe.

As both India and China enter in the global space of high priced, advanced biologics, gene therapy and cell therapy the impact on price and access to life saving drugs is set to impact the cost of global healthcare. Looking deeper at the changes that are being implemented by both the India and Chinese companies that plan to compete in the global market there remain multiple formidable challenges.

Regulatory convergence is primarily driven by the strict regulations of the US and EU which have adopted ICH concepts, guidance and technical harmonization. Now companies from less strict regions who are planning to compete in multi-billion-dollar markets in US, EU, Canada and Japan must address the discrepancy between their own lesser-regulated agencies and the reporting bodies of the off-shore markets they wish to enter. Yet, these newcomer countries and companies are motivated with the potential to internally create high paying jobs and bolstering their middle class. They are focused on developing biosimilars, cell and gene therapy medicines currently which carry high price and high margin in the highly regulated countries.

The motivation to enter the external market is forcing both companies and countries to align their internal/local regulatory processes and focus on one quality system that can support the scrutiny and rigor required to obtain product approval outside the local countries. China current regulatory harmonization effort represents a perfect example of a country that is now embrasing ICH guidances and rewriting their regulatory laws in alignment with both US and EU. For both companies and countries this requires a significant shift in both culture and quality systems which from FDA, EMA and ICH values the traceability and integrity of data above all. The determinant question is whether the scrutiny and the cultural shift to meet higher standards of cost of quality, R&D, development and foreign distribution is worth it?

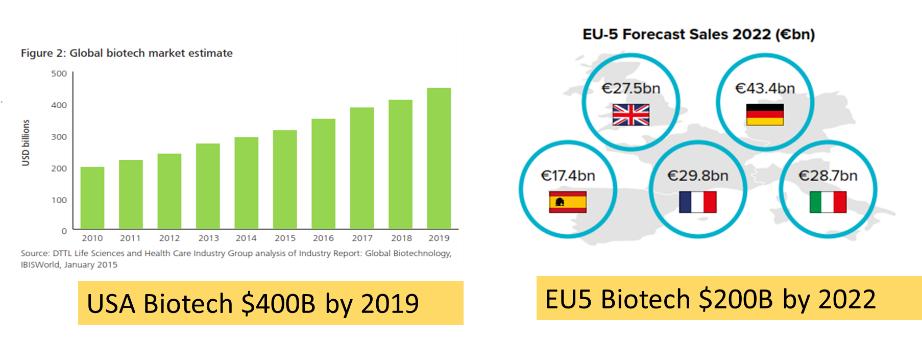

Convergence Price -Global Market $600 Billion

The global biotechnology market coupled with cell and gene therapy is experiencing rapid expansion in the number of new products and the corresponding costs. For example, advanced biotechnology and gene therapy products can cost in excess of $250,000 USD for one treatment and in some cases can cost upward of $1m USD. The combined biotech market for recombinant proteins, monoclonal antibodies, cell and gene therapy for the US and Europe is estimated to be ~$600 billion USD and projected to grow 15% year over year. It could be said that the triple digit profit margin alone entices CEOs from India and China to embrace the regulatory harmonization that converges local regulatory requirements with those in highly regulated countries. Faced with the financial incentives and industry recognition, CEOs and country regulators like India and China have been challenged to think differently.

Thinking Differently

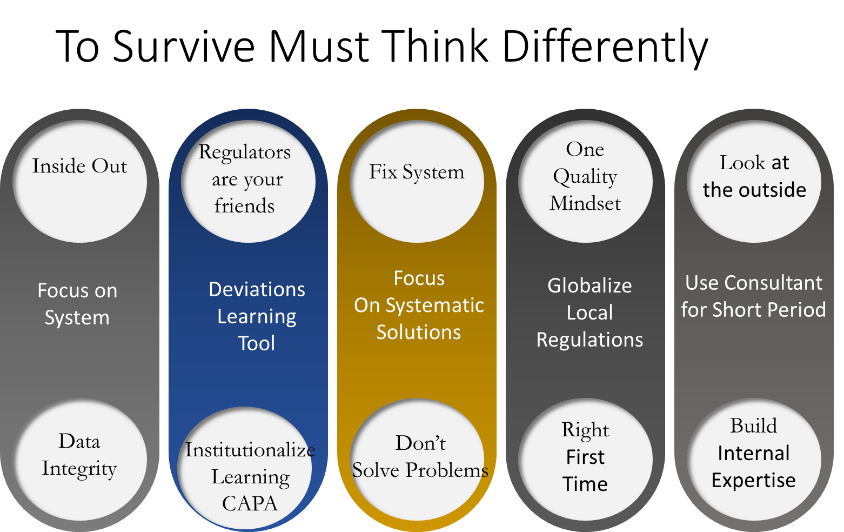

Both countries and CEOs have realized that to enter this high-priced realm of biotechnology they must engage differently, with multiple elements of their business and regulatory culture requiring harmonization in their convergence journey. The successful companies will upgrade their Quality Systems which is anchored in Data Integrity. These companies are abandoning their focus on local regulations and laser focus on ensuring that they meet the highest standard of quality. Changes in this space is not only driven by systems, but require a cultural shift that must be lead from top down. The companies who succeeding are doing this through tight partnership with US and EU firms.

The Regulatory Convergence can be seen as a push and pull relationship between local and global regulators forging a new corporate dynamic, lacking precedence. The companies having the most success engage regulators as an extension of their internal teams and often meet with them to validate internal strategies and development plans. They are also using deviation systems that were typically seen as bad news, now as learning tools. The corrective and preventative actions (CAPA) are transforming old processes into new ones allowing the convergence process to be systematized. The one quality mindset embraced the “early adopter” companies is being implemented across all the facets of the company from R& D, Process Development, manufacturing , quality assurance and supply chain. Companies are also using experienced consultants for short period of time to accelerate their progress to implement their convergence strategy. The short-term consultants are being used as teachers creating internal expertise which are being placed in strategic positions in the companies.

Leadership Challenge

The companies who are embracing the harmonization and convergence are forming and creating international leadership teams and alliances. A example of this is the Mylan and Biocon biosimilar partnership which have recently achieved approvals in both US and EU markets. The company has embraced one quality mindset while leveraging external expertise to enhance their internal practices. They have adopted Mylan’s right first time approach and hired short term consultants to support and accelerate their regulatory convergence. In most cases the successful companies have adopted global regulatory requirements replacing their local systems. The interlaced multinational leadership with local expertise has proven to be a successful model which allows rapid transition from local practices to global convergence.

Regulatory Convergence Starts with R & D

To be able to adopt to internationally recognized technical guidance documents, standards and scientific principles, successful companies have found that regulatory harmonization is required early in the process development life cycle.

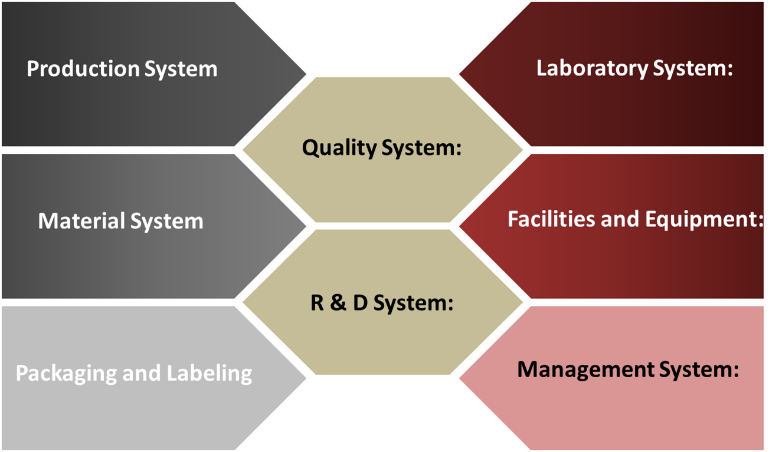

The R&D organization is challenged with the adoption of systems not unlike those being adopted by their commercial sister organization. The management systems along with the typical systems like laboratory, material, facility, production and equipment require bolstering with a mindset that typical of full cGMP operations. Enlighted, early-adopter strategies by successful companies have developed a mid-level organization with systems typically lead by a quality minded team that can straddle both development and the cGMP world. This organization is also leveraged in dealing with complex investigations, complaints and technical transfers to the regulated organizations. The newly created functional team serves as the final referee and ensures appropriate practices and phased appropriate cGMPs are followed and implemented. This organization is typically lead by a highly technical leader with a strong quality and regulatory mindset. This organization also serves as the feeder organization that enables and sends high quality individuals to critical areas like manufacturing, quality control, supplier management, facility and utilities operations.

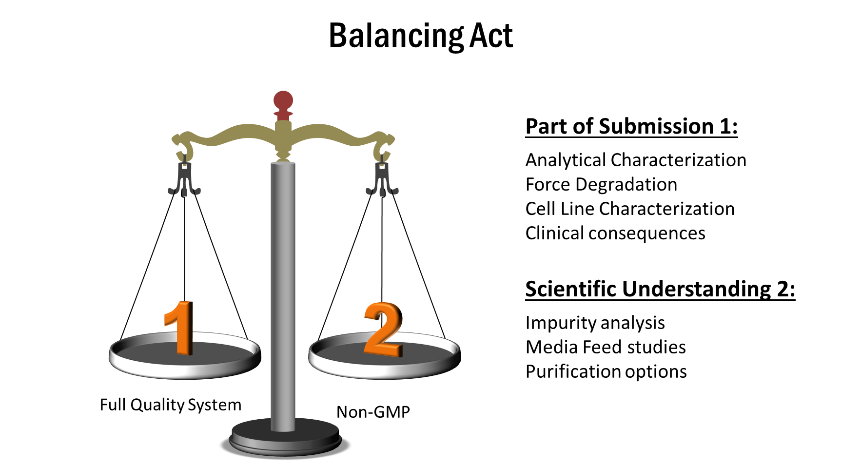

This new organization is constantly balancing and looking closely at the information that will be leveraged and used in the global regulatory submission and ensures all T are crossed and I are dotted from a global regulatory perspective. This organization ensures that key experiments and data are reviewed with a global regulatory lens solely focused on meeting global expectations and as result guides the convergence on project by project basis. The critical question are asked along the progress axis : Is the data going to support submission ? Is the experiment for scientific understanding ? In both situations the data collected by traceable and integral and therefore creating a fuzzy line between cGMP and Non-GMP (Converging speed and quality)

The regulatory harmonization and convergence will play a significant role in the global economy. As the scientific know how, coupled with the global regulatory mindset being adopted by the larger countries takes hold in 2020, we anticipate a lasting impact on the global economy marked by potential launches of products originating from lower-cost countries in Asia and other parts of the world.

2020 Transformative Year and Convergence Benefit Realized

2020 is set to be a transformative year as companies from outside US and EU are filing their products at record pace. The recent biosimilar approvals for complex biologics are providing a lens on the impact that these countries and companies are having on the cost of health care. Europe for example has saved billions of dollars by approving biotech products that originate from other countries. Products that typically cost the health system thousands of dollars have entered the market at 50-70% discount. The approval and successes of both companies and countries who have advance on the regulatory convergence journey have shown that the effort has a significant financial benefit and lasting impact on the global economies. Can’t wait to see the impact on cell and gene therapy products as these countries and companies fully converge to a global regulatory system. Patients will be the ultimate winners as access to highly priced medicines becomes available.

As part of this series of articles I looking to partner with other authors to answer the following questions:

- What is the economic incentive to India and China in these markets, competing against the large cap companies for market share? Is it that lower labor costs will reduce the cost of goods and enable their ability to penetrate global markets?

- If this is true what is outlook long-term as the local standard of living and demand for high wages forces these companies to increase their price, or reduce their profit margin or then seek alternative manufacturing agreements outside their local regions?

As always, I welcome your comments and if you wish to partner with me on writing the next series of articles, please connect with me Robert.Salcedo@biosciencescorp.com